Understand the Benefits and Differences of CNG and RNG

Trending

Top Posts

4 min read

October 18, 2024

Share:

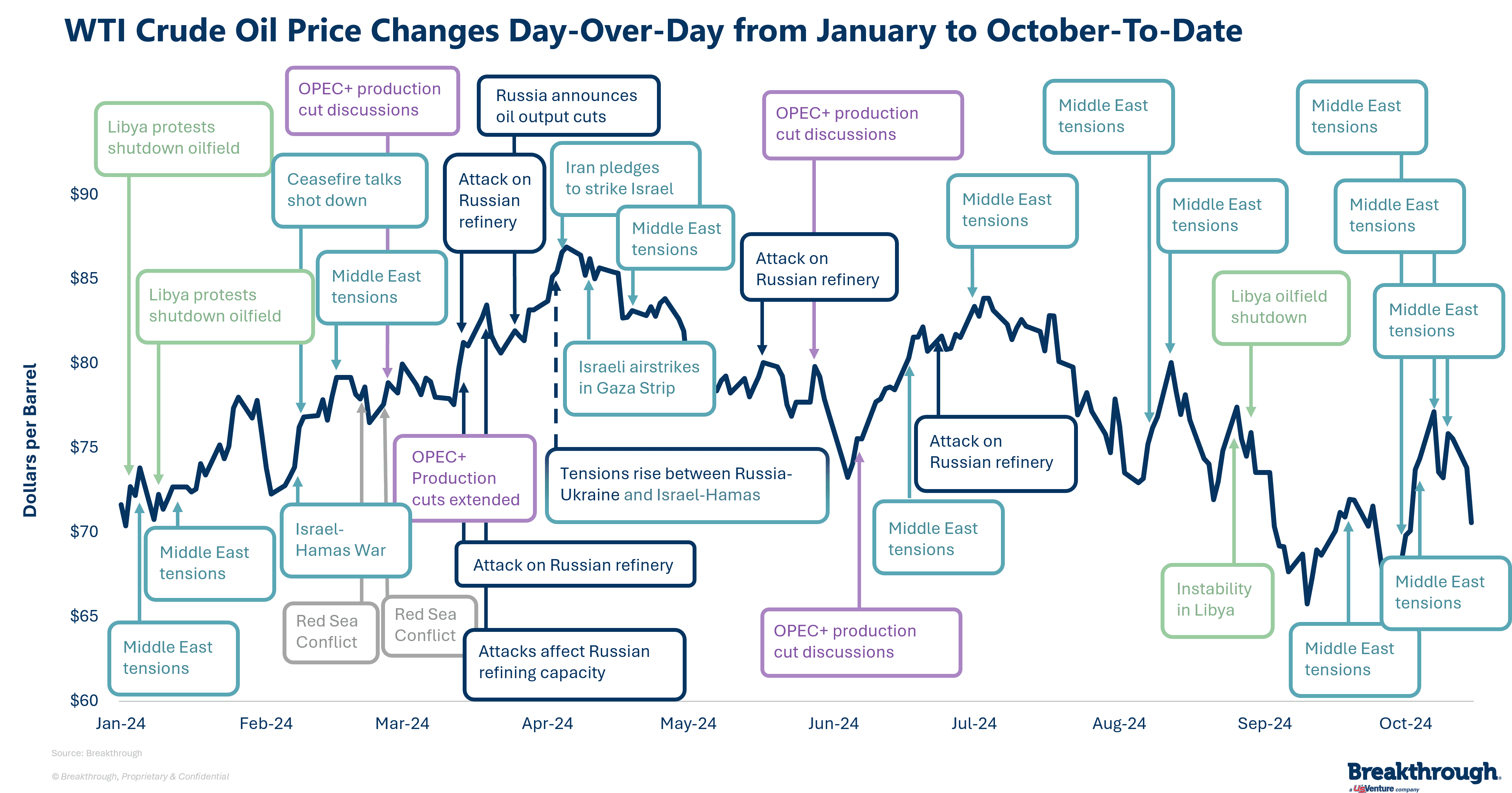

At the start of 2024, it was clear that geopolitical tensions would heavily influence the energy market. Ongoing conflicts, protests, and production cuts were poised to drive volatility. Libya’s protests, the war between Russia and Ukraine, conflicts in the Red Sea, and OPEC+ production cuts were among the key risk factors. Adding to this complexity, 73 global elections impacted energy policy, potentially reshaping market dynamics when they take office.

Recently, a surge in Israel-Iran tensions has heightened market instability. On September 27, an Israeli airstrike in Beirut killed Hezbollah leader Hassan Nasrallah and Iranian Revolutionary Guard Commander Abbas Nilforoushan. Iran retaliated with ballistic missile strikes on Israel, most of which were intercepted. In response, initial fears grew about the potential of an Israel attack on Iran’s energy infrastructure. Since Iran produces roughly 3 million barrels of crude oil daily, disruptions could significantly affect global oil prices.

These events have already impacted crude oil and diesel markets. Prices surged 14% between September 27 and October 7, with West Texas Intermediate (WTI) reaching $77.14 per barrel. However, prices dipped to $70.67 after Israel’s Prime Minister Netanyahu assured U.S. President Biden that Israel's response to Iran’s missile attack would target only military sites, sparing nuclear and oil infrastructure. This reduced the risk premium, calming the market.

Since crude oil makes up about 50% of diesel costs, price changes directly affect transportation expenses. A $1 increase per barrel raises diesel prices by 2.4 cents per gallon, impacting supply chains. Despite these rising tensions, average crude oil prices for the year have remained stable. WTI crude oil have averaged $77.40 per barrel, a mere 0.1% decline from the same period last year. This price stability can be attributed to two main factors: limited disruption to energy infrastructure from geopolitical conflicts and a year-over-year decrease in global demand due to sluggish economic growth. Still, the situation remains precarious. A direct Israeli attack on Iranian energy assets could push prices higher, especially if the conflict expands to involve major global players like the U.S., China, and Russia.

On the domestic front, the U.S. energy market faces its own challenges—namely, hurricane season. Hurricane Helene and Hurricane Milton have severely impacted Florida and neighboring states, including North Carolina and Tennessee. Freight operations have been significantly disrupted, with vital interstates sustaining damage and repairs expected to take months. At one point, around 30% of offshore oil production was halted. However, offshore oil production is recovering and expected to return online quickly, which should minimize long-term impacts on energy prices.

The hurricanes have also created temporary shifts in freight demand and diesel prices. Typically, freight activity spikes before a storm, slows during the event, and surges again as recovery begins. However, with two powerful storms hitting in quick succession, the recovery process has been slower. As shown in the visual, diesel prices rose slightly due to pre-storm demand but dropped quickly before stabilizing as recovery efforts progressed.

In summary, the energy market is being pulled in multiple directions. Geopolitical conflicts and hurricane season in the U.S. are adding an extra layer of complexity to seasonal trends. Although current average crude oil prices remain stable, the situation is dynamic. A major escalation in the Israel-Iran conflict or further storms could push prices higher, creating new challenges for supply chains and transportation costs in the months ahead.

For tailored insights on how energy market volatility will impact your transportation network, contact Breakthrough's Research and Economics team. Our experts are ready to share the in-depth analysis and strategic guidance you need to navigate the complexities of today’s energy and freight markets.

5 min read

April 4, 2025

Explore how U.S. tariffs, OPEC+ production hikes, and Canada's carbon tax removal drove diesel prices down, creating volatility in global energy markets.

Read more

4 min read

April 3, 2025

Implement Fuel Recovery to improve transparency, reduce costs, and enhance efficiency in European transport with Breakthrough's proven strategies.

Read more

3 min read

March 27, 2025

Discover how a TMS streamlines planning, execution, and logistics with real-time visibility, automation, and data-driven insights to optimize freight moves.

Read more